As covered in the segment on the national economy, there are thousands of leading indicators from which to forecast future conditions. There are exponentially fewer at the local/regional level to track economic shifts. We rely on population, employment, wages, and housing trend data to forecast the financial future. Here’s a brief synopsis of what we see happening.

Population

According to official estimates from PSU’s Center for Population Research, Crook County added 1,424 residents in 2022 for a year-over-year growth rate of 2.4% – the highest in Oregon. Deschutes County added 9,308 new residents for a 2.1% growth rate (2nd highest) and Jefferson 902 for a 1.6% rate, tied for the 4th fastest rate in the state. This contrasts with Multnomah County, which lost 5,186 residents – one of only three counties with a declining population this past year. Of the 44,595 newly minted Oregon residents in 2022, 26.1% were located in the Central Oregon region, although the tri-county area has only about 5% of the state’s total population. Sustained population growth has been a significant contributor to the region’s economy, outperforming all other parts of the state and all but a few places in the nation. That trend is still in play.

Employment

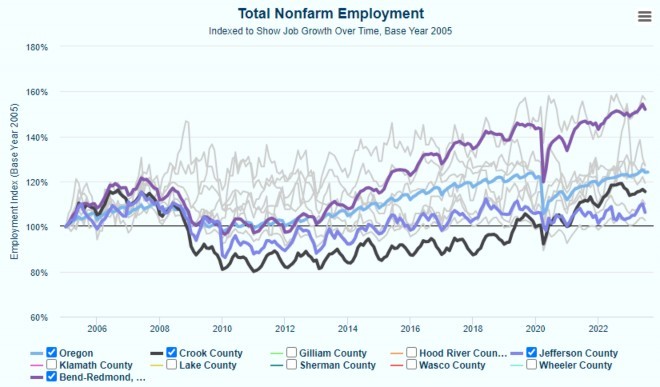

Our region’s total number of employed residents is seasonal, with the highest figures typically at the end of summer and the lowest in January/February, as shown in the “heartbeat” chart below. Crook and Jefferson Counties are returning to near-record employment levels, while Deschutes County surpassed previous record levels in mid-2021 – exceeding the 154% index mark. Meanwhile, Oregon, as a whole, was 124% over the same period.

It’s still too early to call a trend, but employment growth in the region is showing signs of slowing beyond normal seasonality in recent months – a development to watch as the year progresses.

Salaries and Wages

In Crook County, total wages for the Information industry (i.e., software and data centers) eclipsed all others. They were more than twice the all-government employment group, the second-highest gross wages. Today, 37.3% of all private wages paid in the county are in the information industry. Building product manufacturing continues to be an essential industry for Prineville, Crook’s only incorporated city.

Wages in Deschutes County, roughly ten times those in Crook, have more industry sectors across which payrolls are distributed. The information sector – primarily software, not data centers – is a share of total employment, much smaller than Crook, but also well-paying with annual average wages of $111,400. Along with other tech sectors, much of the region’s leisure and hospitality employment and a concentration of education and health services are centered here.

Jefferson County’s payrolls, as a percentage, are weighted more heavily on agriculture and, like Crook, building products. Madras has among the highest per capita manufacturing jobs in the entire state. With rising inflation, wages are increasing in Jefferson, but at a slower pace than the rest of the region and the state – an ongoing trend that has been in play for over two decades.

Housing Inventory & Cost

Housing costs have been an economic headwind for the region for several years as values have dramatically outpaced income growth. According to the September Beacon Report (Aug. 2023 data), Bend’s median sales price was $742,000, $694,000 in Sisters, $505,000 in Redmond, $409,000 in Crook County, $401,000 in La Pine, and $348,000 in Jefferson County. Despite higher interest rates, days on the market have not spiked dramatically in the region as a higher percentage of sales are to buyers bringing significant equity or cash. For example, in Redmond, 38% of sales were cash in August 2023 versus 24% in August 2021. In Bend, the median days on the market were 16, with two months of inventory. Those same stats for Redmond are 16 and 3, 27 and 3 in Sisters, 20 and 5 in La Pine, 11 and 3 in Jefferson County, and 23 and 4 in Crook County. That’s all to say that while higher mortgage rates have slowed sales volume and timing, the Central Oregon region is not glutted with supply (a 5-6 month supply is considered equilibrium for buyers and sellers). We see this as a further sign of economic strength, no doubt helped by ongoing strong population in-migration.

These are just a few highlights of a few regional economic indicators – there are dozens more. It is rare for Central Oregon to be fully insulated from national economic conditions, but the “soft landing” expected for the U.S. economy could be even softer for the tri-county area on the way to more robust growth in the following years.